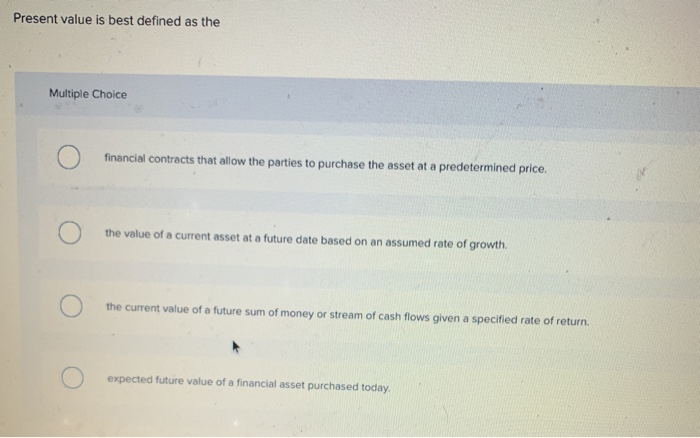

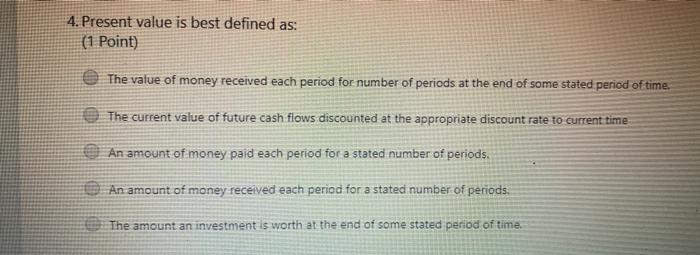

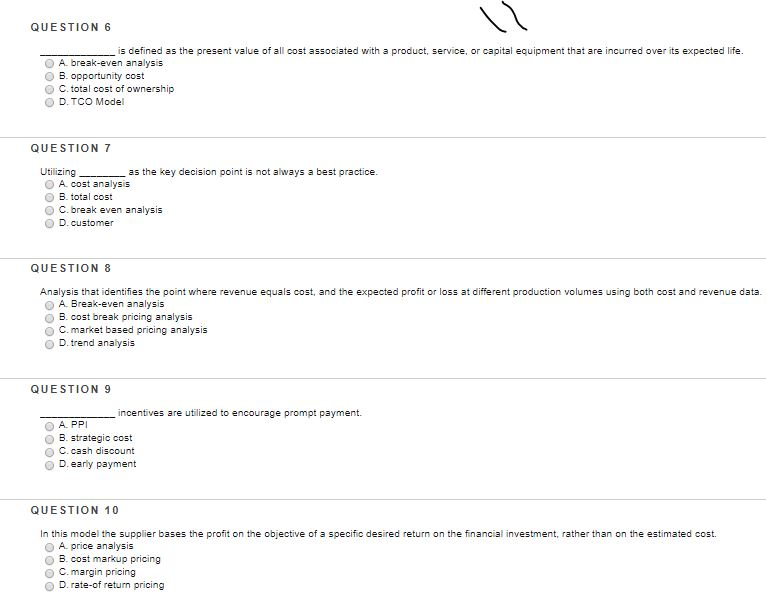

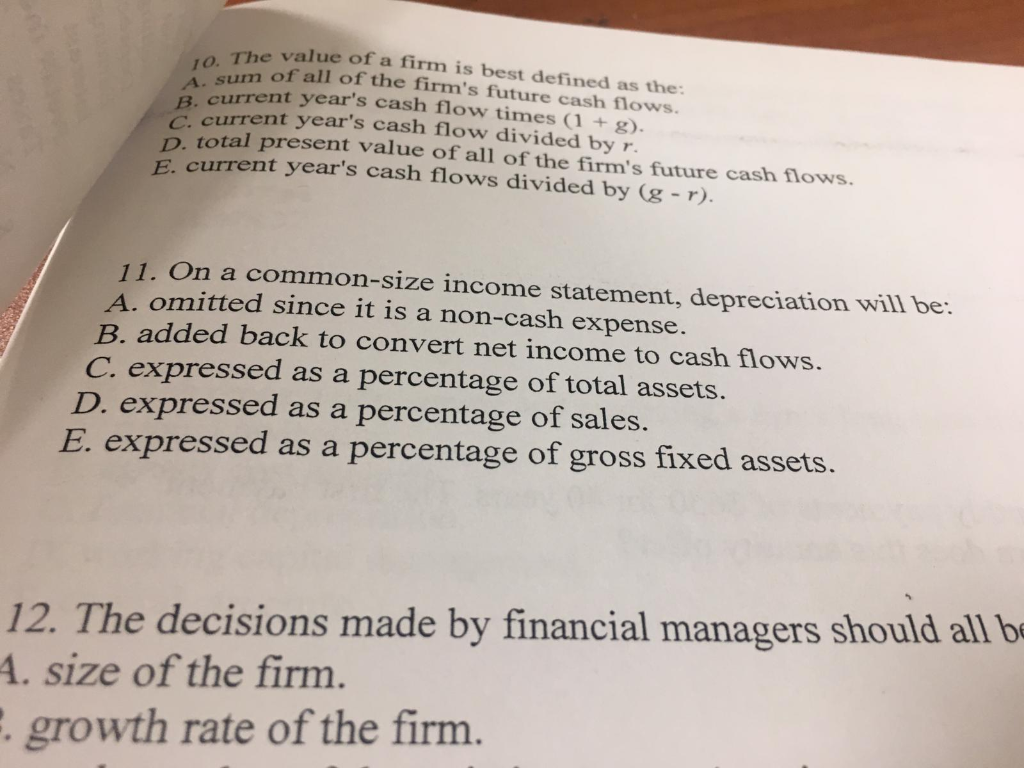

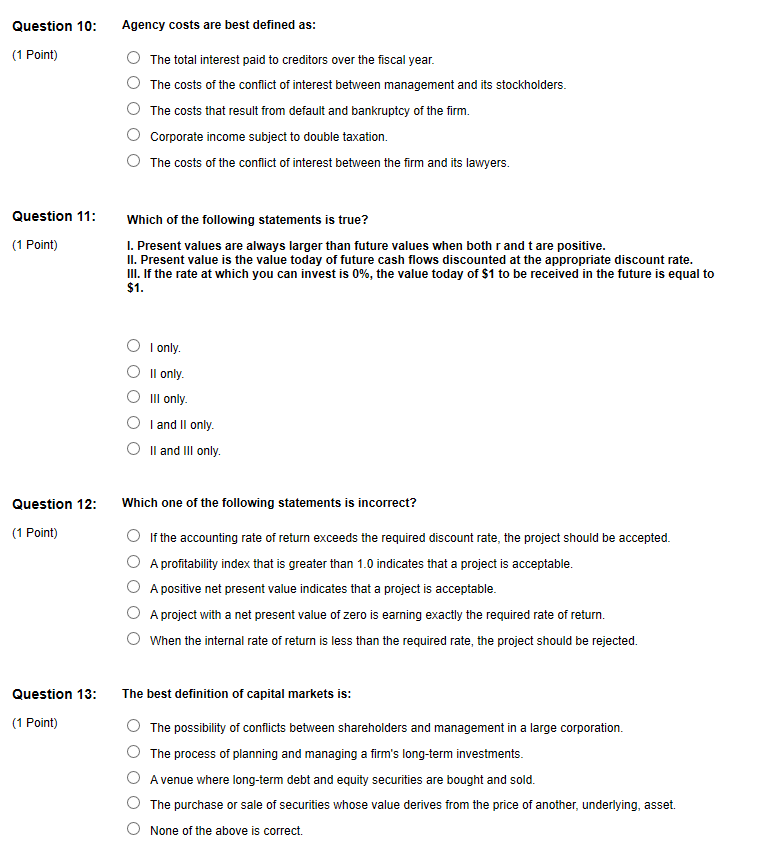

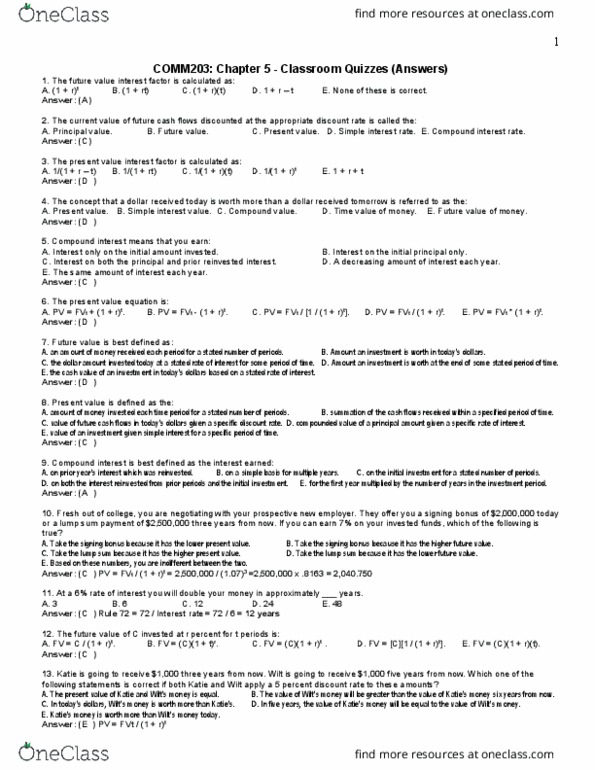

Present Value Is Best Defined As The:

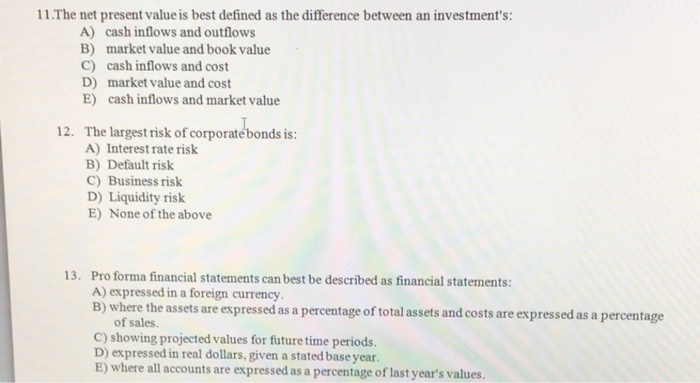

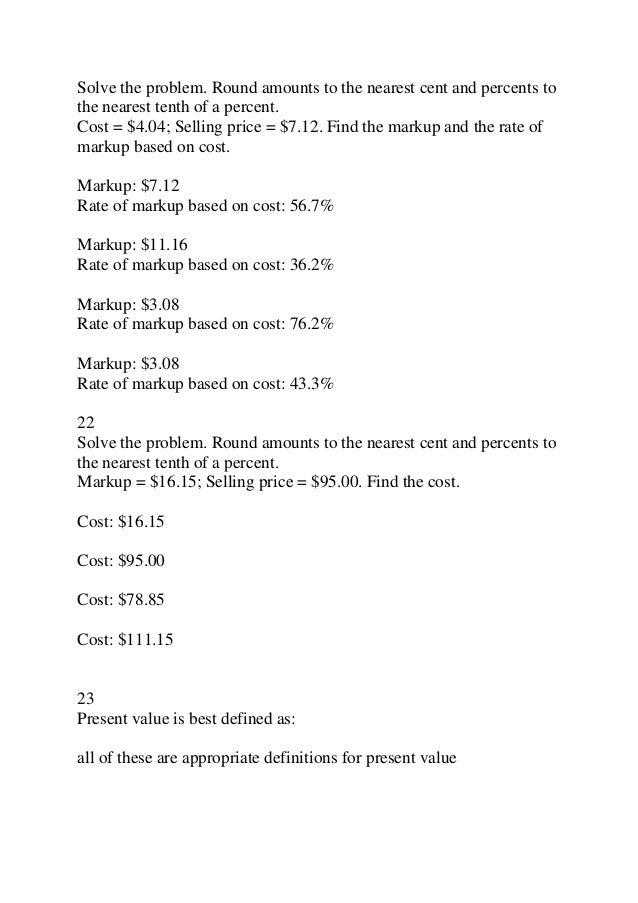

Present value is best defined as the:. 3 present value of the investments future cash flows minus the investments cost. Present value is best defined as. The net present value is best defined as the difference between an investments.

2 net value received at the end of the investment period. The amount that must be invested per year and compounded at a specified rate and time to reach a specified present value. The present value of future cash flows is always less than the same amount of future cash flows since you can immediately invest cash received now thereby achieving a greater return than.

Present value is best defined as. Market value and its cost. Payback period Which one of the following correctly.

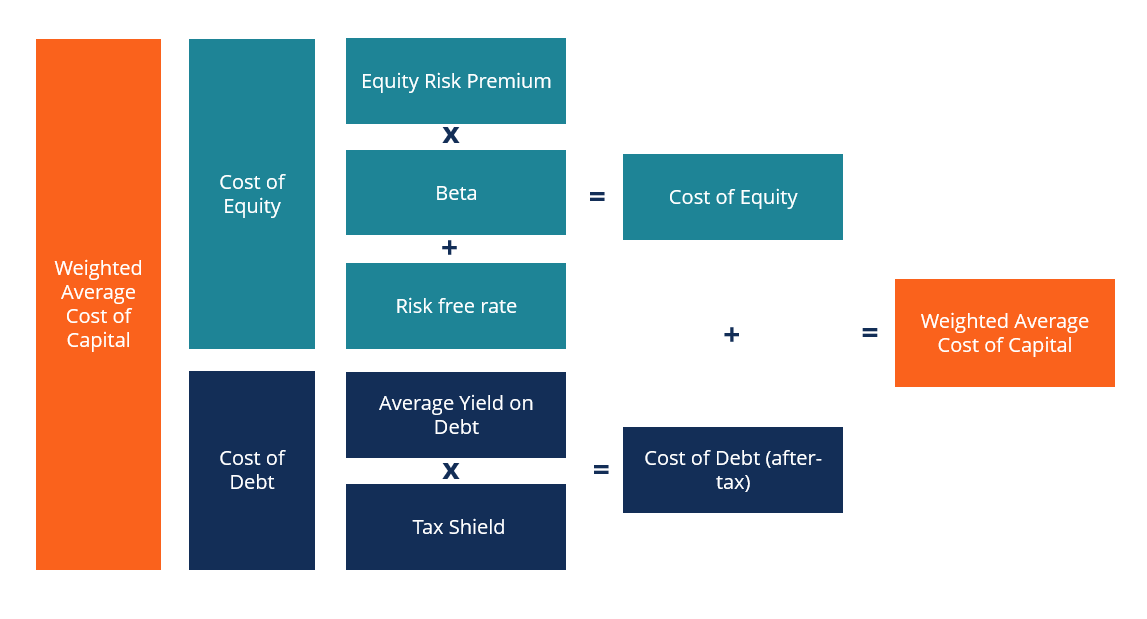

The amount that must be invested now and compounded at a specified rate and time to reach a specified future value b. All of these are appropriate definitions for present value. Discounted cash flow valuation.

Simply put because of the passage of time todays money is worth more than the same money tomorrow. The net present value is best defined as the difference between an investments. Knowing the present value of an annuity can help you figure out exactly how much value you have left in the annuity you purchased.

Put in simple terms the present value represents an amount of money you need to have in your account today to meet a future expense or a series. The amount of a specified future value. In other words money received in the future is not worth as much as an equal.

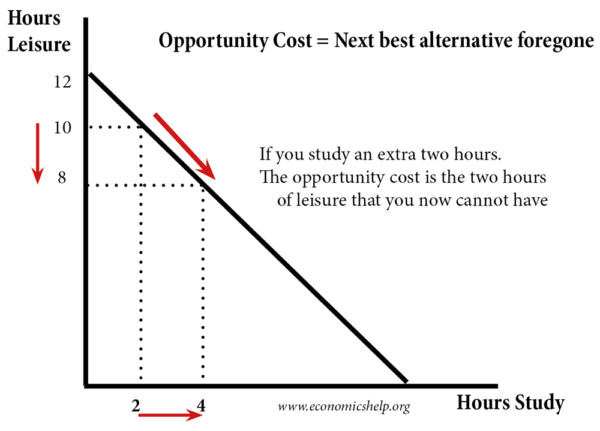

The period of time it takes an investment to generate sufficient cash flows to recover its initial cost is called the. Present value is the concept that states an amount of money today is worth more than that same amount in the future.

All of these are appropriate definitions for present value.

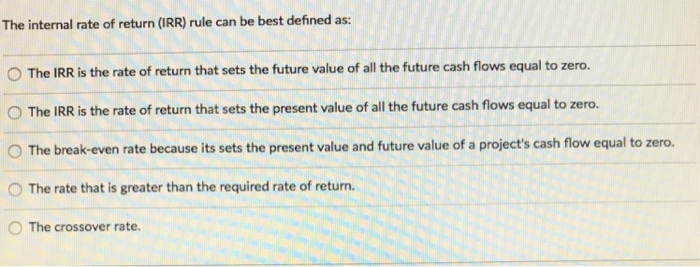

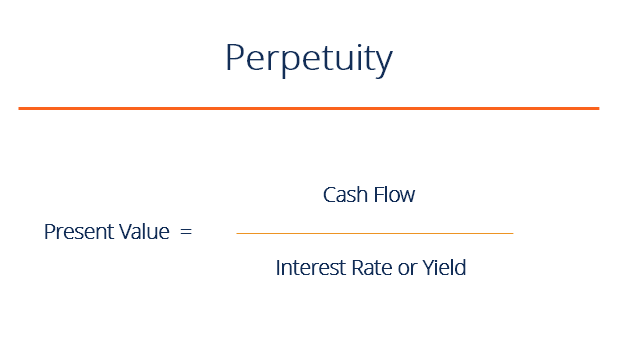

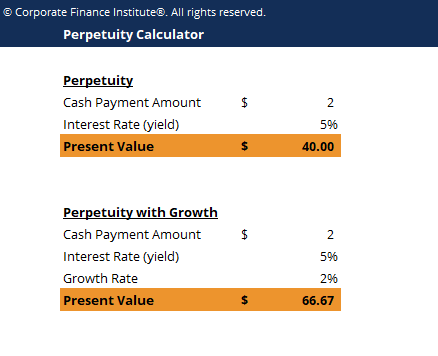

Present value is the concept that states an amount of money today is worth more than that same amount in the future. Present value is best defined as. The best illustration of the theory of time value of money and the need to compensate or pay additional risk-based interest rates is a correlation of present value PV with future value FV. Present value is the current worth of cash to be received in the future with one or more payments which has been discounted at a market rate of interest. Market value and its cost The process of valuing an investment by discounting its future cash flows is called. In other words money received in the future is not worth as much as an equal. 3 present value of the investments future cash flows minus the investments cost. The amount of a specified future value. Present value is best defined as.

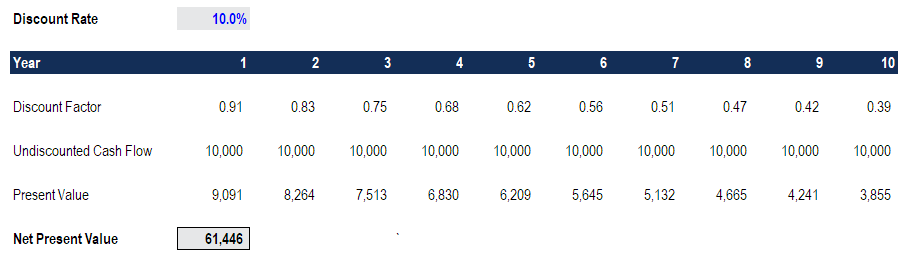

Present value is the concept that states an amount of money today is worth more than that same amount in the future. Net present value or NPV is used to calculate the total value today of a future stream of payments. The amount of a specified future value. Put in simple terms the present value represents an amount of money you need to have in your account today to meet a future expense or a series. The present value of future cash flows is always less than the same amount of future cash flows since you can immediately invest cash received now thereby achieving a greater return than. If the NPV of a project or investment is positive it means that the discounted present value. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates when the.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

:max_bytes(150000):strip_icc()/JamesHeadshot-PeggyJames-9f712f1197374a9b824289fe0d5ec842.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_An_Introduction_to_Capital_Budgeting_Sep_2020-05-d479e099d1744e149a7690ab744900da.jpg)

/what-is-history-collection-of-definitions-171282_V2-01-5c8a853646e0fb000176fffe.png)

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

/what-is-the-definition-of-art-182707_v3-a380a697fd2f44fa965854bde8cf6a06.png)

Posting Komentar untuk "Present Value Is Best Defined As The:"